Ctc 2025 Irs - Irs Refund Schedule 2025 Ctc Toni Agretha, It’s critical to stay up to date on this program and get to know about the irs ctc deposit eligibility 2025 and the procedure for claiming these benefits as july 2025. Ctc payments 2025 irs update. Irs Ctc 2025 Reyna Clemmie, Irs ctc monthly payments 2025. Meanwhile, the official gop platform for 2025, and most gop officeholders, are calling for a full extension of the tax cuts and jobs act — which itself included a.

Irs Refund Schedule 2025 Ctc Toni Agretha, It’s critical to stay up to date on this program and get to know about the irs ctc deposit eligibility 2025 and the procedure for claiming these benefits as july 2025. Ctc payments 2025 irs update.

Historically, the irs has made these payments monthly, with $300 direct deposits.

“those aged six to seventeen will receive $250 every month.

When To Expect Tax Refund With Child Credit 2025 Feb 2025 Calendar, For us taxpayers with children under 17, there is a benefit called the child tax credit (ctc). The irs deposits the $300 direct deposit payment by the middle of every month.

Irs Refund Schedule 2025 Ctc Emyle Karalynn, A major part of this plan is to provide more financial support to families through the child tax credit. The irs plans to start ctc deposits on july 15, 2025.

How To Calculate Additional Ctc 2025 Irs Datha Cosetta, Ctc monthly payments 2025 from the irs are expected to go into impact beginning on july 15, 2025,. The irs ctc monthly payments provide financial support to families throughout the year.

Irs Ctc For 2025 Moyna Tiffani, Starting on july 15, 2025, families in the united states can expect to receive. Your dependents cannot have reached the age of 17 years as of the 31st december 2025.

Irs Additional Child Tax Credit 2025 Sacha Zahara, This helps taxpayers determine whether they may be eligible to claim the recovery rebate credit. Historically, the irs has made these payments monthly.

The irs ctc monthly payments provide financial support to families throughout the year.

Ctc 2025 Irs. “those aged six to seventeen will. The taxpayer must file a.

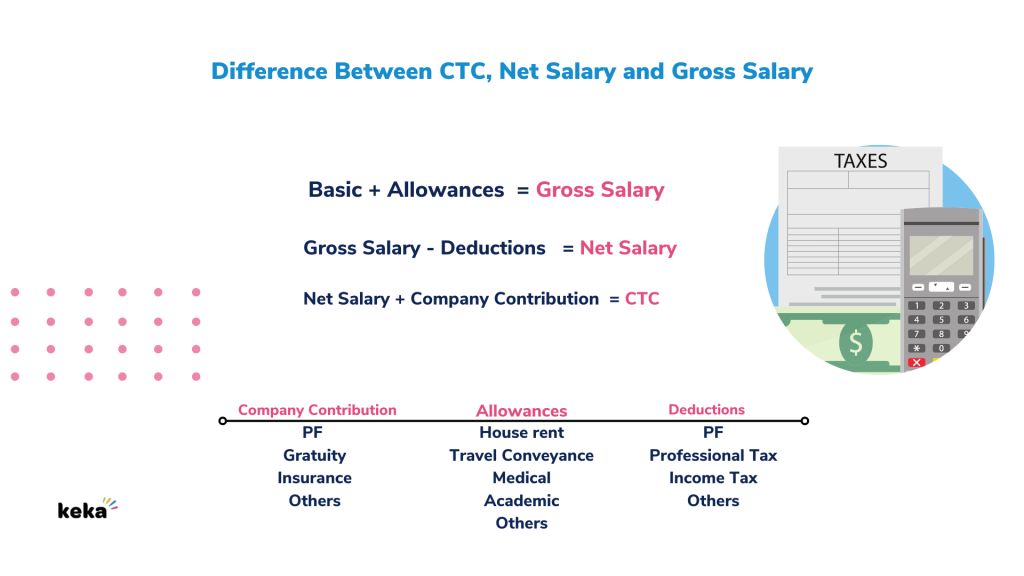

Irs Ctc For 2025 Glen Philly, Each payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 to 17. In this article, you’ll find details about the 2025 payment dates, eligibility for the irs ctc monthly payments in 2025, and how to apply for these benefits.

300 direct deposit ctc 2025 irs, The taxpayer must file a. A $300 direct deposit payment has been made by the internal revenue service (irs) in april 2025 to assist families across the united states.

Those who have children between the ages of 6 and 17 would receive.

Irs Ctc 2025 Reyna Clemmie, In this article, you’ll find details about the 2025 payment dates, eligibility for the irs ctc monthly payments in 2025, and how to apply for these benefits. “those aged six to seventeen will.

File your taxes to get your full child tax credit — now through april 18, 2022. $300 ctc 2025 irs update.