Tsp Roth Max Contribution 2025 - "Can you have a Roth TSP and a Roth IRA?" Plan Your Federal Retirement, Irs releases 2025 401k (tsp) and ira limits. the contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government's. Why Transferring Traditional TSP to a Roth IRA Makes Sense for Many, You must calculate how much to contribute each month to max $23,000 for 2025 ( tsp) and contribute 5% in december. For the year 2025 , the new.

"Can you have a Roth TSP and a Roth IRA?" Plan Your Federal Retirement, Irs releases 2025 401k (tsp) and ira limits. the contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government's.

In 2025, it goes up to $23,000, plus $7,500 if you're age 50 or older.

TSP Matching Military 2022 Maximize Contributions with BRS, Roth ira contribution limits for 2025. You can try to gnat's ass it by over contributing,.

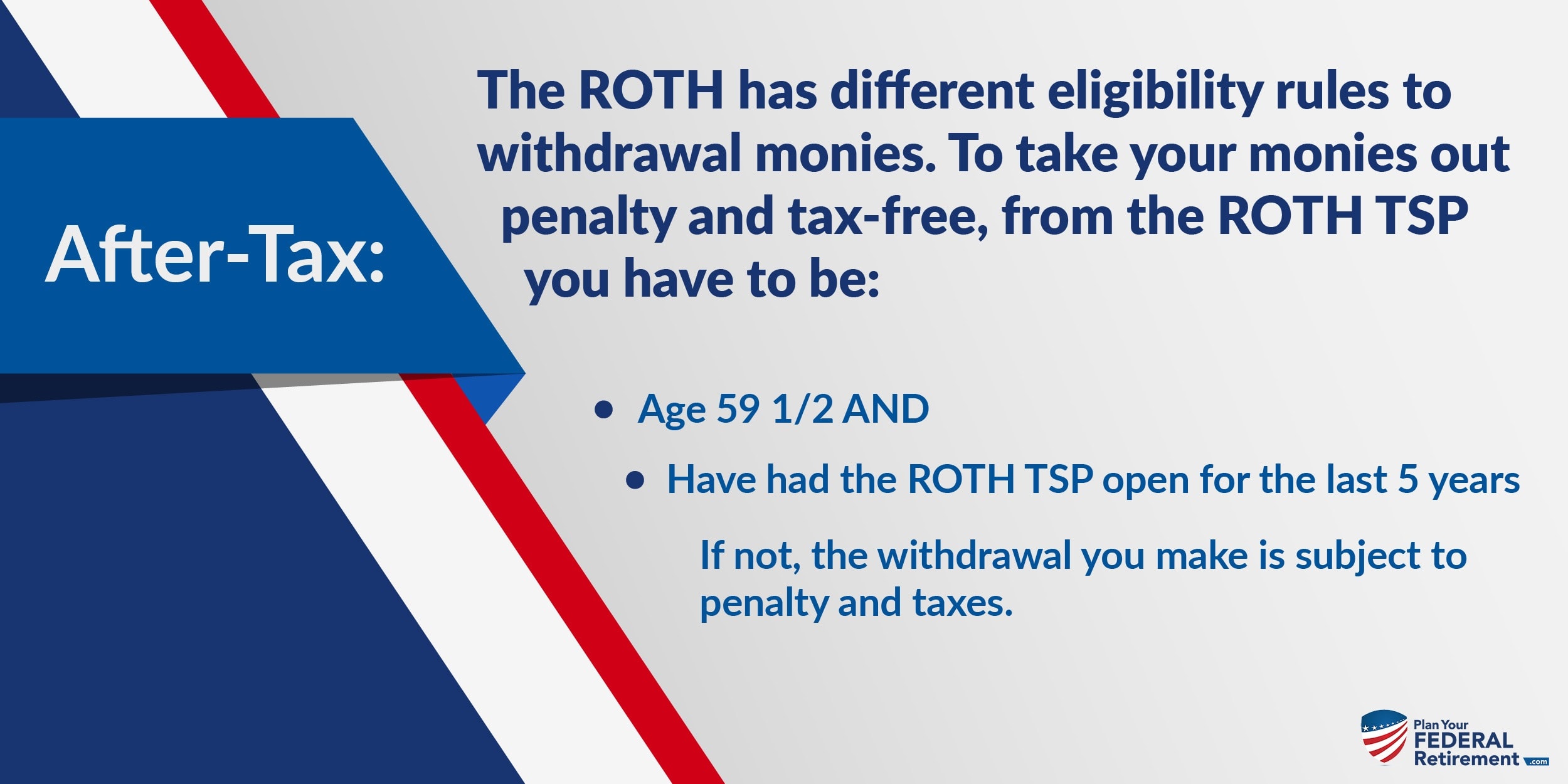

Roth IRA Limits And Maximum Contribution For 2021, With roth tsp, your contributions go into the tsp after tax withholding. The annual contribution limit for the thrift savings plan (tsp) will increase by 2.2% in 2025 according to mercer, a benefits consulting firm that is part of marsh.

Roth 401k Limits 2025 Alicia Kamillah, The annual contribution limit for the thrift savings plan (tsp) will increase by 2.2% in 2025 according to mercer, a benefits consulting firm that is part of marsh. the contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government's.

You must calculate how much to contribute each month to max $23,000 for 2025 ( tsp) and contribute 5% in december. The 2025 annual contribution limit for the tsp is $23,000 per year, an increase of 2.2% over the 2025 annual limit, so it represents a.

401k 2025 Contribution Limit Chart, Roth thrift saving plan (tsp) contribution limits federal law limits employee contributions to a roth tsp to $20,500 for 2022 and $22,500 for 2025. Roth ira contribution limits for 2025.

2025 Will Witness More Roth Account Activity In The Thrift Savings Plan, In 2025, it goes up to $23,000, plus $7,500 if you're age 50 or older. The 2025 annual contribution limit for the tsp is $23,000 per year, an increase of 2.2% over the 2025 annual limit, so it represents a.

You can try to gnat's ass it by over contributing,.

TSP Max Contribution 2025 Military BRS Match Per Pay Period, Roth ira contribution limits for 2025. With roth tsp, your contributions go into the tsp after tax withholding.

Roth TSP vs. Roth IRA 3 differences to know before investing, The 2025 tsp contribution limit ended up being precisely in line with projected estimates that were released over the summer. Roth thrift saving plan (tsp) contribution limits federal law limits employee contributions to a roth tsp to $20,500 for 2022 and $22,500 for 2025.

the contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government’s.

Tsp Roth Max Contribution 2025. That's for a roth tsp, a traditional tsp, or even a combination of accounts if you have more than one. Use the tsp annuity calculator to estimate how much monthly life annuity payments could be if you use part or all of your tsp account to purchase an annuity.

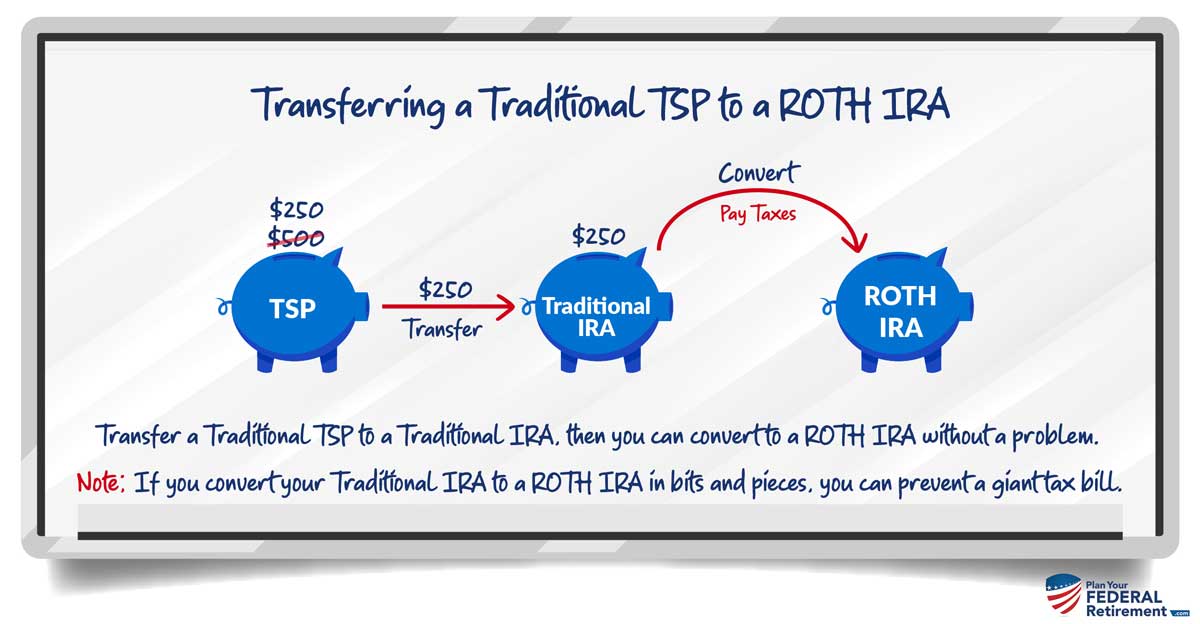

"How can I convert some of my TSP dollars into my ROTH?" Plan Your, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50. The 2025 tsp contribution limit for the will increase by $500 from $22,500 in 2025 to $23,000 next year according to mercer, a financial services consulting firm.